As you delve into the realm of Schengen travel insurance, a world of protection and peace of mind awaits. From understanding the basics to navigating the intricacies, this guide will equip you with the knowledge needed to make informed decisions during your travels.

Let's begin by unraveling the layers of Schengen travel insurance and uncovering its significance in today's global adventures.

Overview of Schengen Travel Insurance

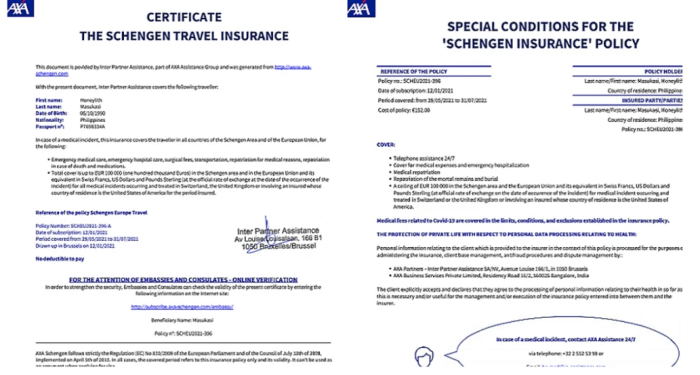

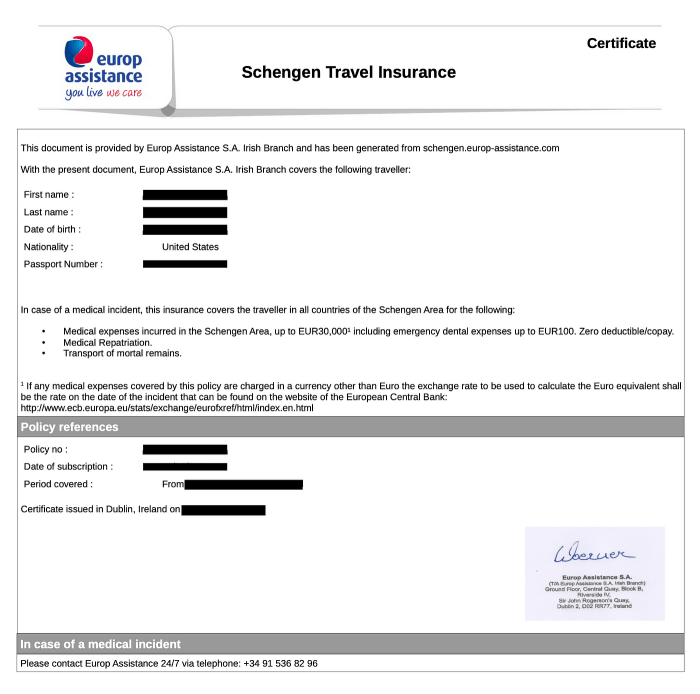

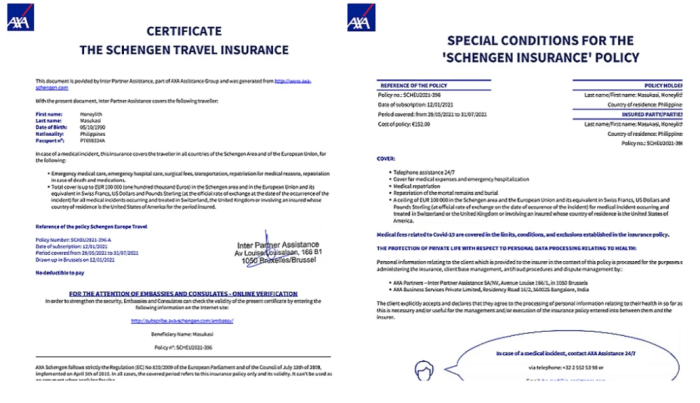

Schengen travel insurance is a type of insurance policy specifically designed to cover travelers visiting countries within the Schengen Area in Europe. It is a mandatory requirement for obtaining a Schengen visa, providing financial protection in case of unexpected events during the trip.

Importance of Having Schengen Travel Insurance

Having Schengen travel insurance is crucial for travelers as it offers protection and assistance in various situations. Some key reasons why it is important include:

- Medical Emergencies: In case of illness or injury while traveling, the insurance covers medical expenses, hospitalization, and repatriation.

- Travel Delays or Cancellations: If flights are delayed or canceled, the insurance can provide coverage for additional expenses incurred.

- Lost or Stolen Belongings: Reimbursement for lost or stolen luggage, personal belongings, or travel documents is included in the coverage.

Coverage Offered by Schengen Travel Insurance Policies

Schengen travel insurance policies typically offer the following coverage:

- Emergency Medical Expenses

- Emergency Medical Evacuation

- Repatriation of Remains

- Travel Delay or Cancellation Coverage

- Baggage Loss or Delay Reimbursement

Requirements for Schengen Travel Insurance

To travel to Schengen countries, it is mandatory to have Schengen travel insurance. This insurance provides coverage for medical emergencies, accidents, repatriation, and other unforeseen events during your trip.

Countries Requiring Schengen Travel Insurance

- All 26 Schengen countries require visitors to have Schengen travel insurance. These countries include popular destinations such as France, Italy, Germany, Spain, and Greece.

Minimum Coverage Amount

- According to Schengen regulations, the minimum coverage amount for Schengen travel insurance is €30,000. This coverage is essential to ensure that you are financially protected in case of medical emergencies or accidents while traveling in Schengen countries.

Specific Medical Coverage Required

- Schengen countries require travel insurance to cover medical expenses, including hospitalization, emergency treatment, and repatriation in the event of serious illness or injury. It is crucial to verify that your insurance policy meets these specific medical coverage requirements.

Obtaining Schengen Travel Insurance

- You can obtain Schengen travel insurance from various insurance providers, travel agencies, or online platforms specializing in travel insurance. Make sure to choose a policy that meets the minimum coverage amount and specific medical requirements set by Schengen countries.

Types of Schengen Travel Insurance

When it comes to Schengen travel insurance, there are different types available to suit the varying needs of travelers. Understanding the differences between these types can help you choose the right one for your trip.

Single-Trip vs. Multi-Trip Schengen Travel Insurance

Single-trip Schengen travel insurance covers you for a specific trip within the Schengen area. It provides coverage for the duration of that particular trip. On the other hand, multi-trip Schengen travel insurance is designed for frequent travelers who take multiple trips to the Schengen area within a specified period.

It offers coverage for multiple trips within a year, making it more convenient for frequent travelers.

Basic vs. Comprehensive Schengen Travel Insurance

Basic Schengen travel insurance typically offers essential coverage such as medical expenses, emergency medical evacuation, and repatriation of remains. It provides basic protection for unforeseen events during your trip. On the other hand, comprehensive Schengen travel insurance offers a wider range of coverage, including trip cancellation, baggage loss, and personal liability.

It provides more extensive protection and peace of mind for travelers.

Benefits of Each Type of Schengen Travel Insurance

- Single-trip insurance is suitable for one-time travelers and provides coverage for a specific trip.

- Multi-trip insurance is ideal for frequent travelers and offers convenience and cost savings for multiple trips.

- Basic insurance provides essential coverage for medical emergencies and unforeseen events during your trip.

- Comprehensive insurance offers a broader range of coverage, including trip cancellations and baggage loss, providing more comprehensive protection.

Recommendations for Selecting the Right Type of Schengen Travel Insurance

When choosing Schengen travel insurance, consider factors such as the frequency of your trips, the level of coverage you need, and your budget. If you travel frequently, multi-trip insurance may be more cost-effective. For comprehensive protection and peace of mind, opt for comprehensive insurance.

Evaluate your needs and preferences to select the type of Schengen travel insurance that best suits your travel requirements.

Claim Process for Schengen Travel Insurance

When it comes to filing a claim with Schengen travel insurance, there are specific steps that need to be followed to ensure a smooth process. Understanding the documentation required and the typical timeline for processing a claim is essential for a hassle-free experience.

Filing a Claim

- Contact the Schengen travel insurance provider as soon as possible after the incident occurs to notify them of the claim.

- Fill out the claim form provided by the insurance company, ensuring all details are accurate and complete.

- Gather all necessary documentation to support your claim, such as medical reports, police reports, proof of expenses, and any other relevant paperwork.

- Submit the completed claim form and supporting documents to the insurance company within the specified timeframe.

Documentation Required

- Medical reports detailing the nature of the injury or illness sustained during the trip.

- Police reports in case of theft, loss of belongings, or any other criminal incident.

- Proof of expenses incurred as a result of the incident, such as receipts, invoices, or bills.

- Any other relevant documentation requested by the insurance company to substantiate the claim.

Timeline for Processing a Claim

- The typical timeline for processing a claim with Schengen travel insurance can vary depending on the complexity of the case and the availability of required documentation.

- Generally, insurance companies aim to process claims within a few weeks to a couple of months from the date of submission.

- It is essential to follow up with the insurance company regularly to inquire about the status of your claim and provide any additional information requested promptly.

Tips for a Smooth Claim Process

- Read and understand the terms and conditions of your Schengen travel insurance policy to know what is covered and how to file a claim.

- Keep all receipts, invoices, and documentation related to your trip to facilitate the claim process in case of an incident.

- Notify the insurance company promptly after the incident and follow their instructions carefully to ensure a timely and successful claim submission.

- Stay proactive and engaged throughout the claim process, responding promptly to any requests for additional information or documentation.

Ultimate Conclusion

In conclusion, Schengen travel insurance serves as a vital shield against unforeseen circumstances while journeying through the picturesque landscapes of Europe. With the right policy in hand, you can explore with confidence and embrace the wonders that await you.

Answers to Common Questions

Is Schengen travel insurance mandatory for all European countries?

While it's not mandatory for all European countries, it is a requirement for Schengen Area countries.

What is the minimum coverage amount needed for Schengen travel insurance?

The minimum coverage amount required is €30,000 for medical emergencies and repatriation.

How do I file a claim with Schengen travel insurance?

To file a claim, you typically need to contact your insurance provider and submit the necessary documentation such as medical reports and receipts.

Can I purchase Schengen travel insurance after arriving in Europe?

It is recommended to purchase Schengen travel insurance before your trip to ensure coverage from the start of your journey.