Embark on a journey through the world of nationwide travel insurance, unraveling the intricacies and benefits that come with this essential coverage. As travelers venture near and far, having the right insurance can make all the difference in ensuring a smooth and worry-free trip.

Exploring the nuances of coverage options, claim processes, and exclusions can empower travelers to make informed decisions and enjoy their adventures with peace of mind.

What is Nationwide Travel Insurance?

Nationwide Travel Insurance is a comprehensive insurance policy designed to protect travelers from unforeseen circumstances while they are away from home. It offers coverage for a wide range of situations that can occur during travel, providing peace of mind and financial security.

Coverage Offered by Nationwide Travel Insurance

- Medical emergencies and evacuation

- Trip cancellation or interruption

- Lost or delayed luggage

- Travel delays

- Emergency assistance services

Benefits of Choosing Nationwide Travel Insurance

- Financial protection in case of trip cancellation or interruption

- Coverage for medical emergencies and evacuation

- Assistance services for emergencies while traveling

- Peace of mind knowing you are protected during your trip

Examples of Situations Where Nationwide Travel Insurance Would be Beneficial

- Unexpected illness or injury requiring medical attention abroad

- Flight cancellations leading to additional expenses for accommodation or alternative transportation

- Luggage getting lost or stolen during travel

- Natural disasters affecting travel plans

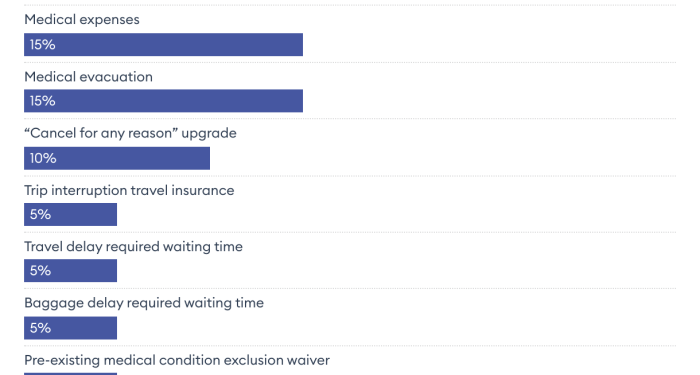

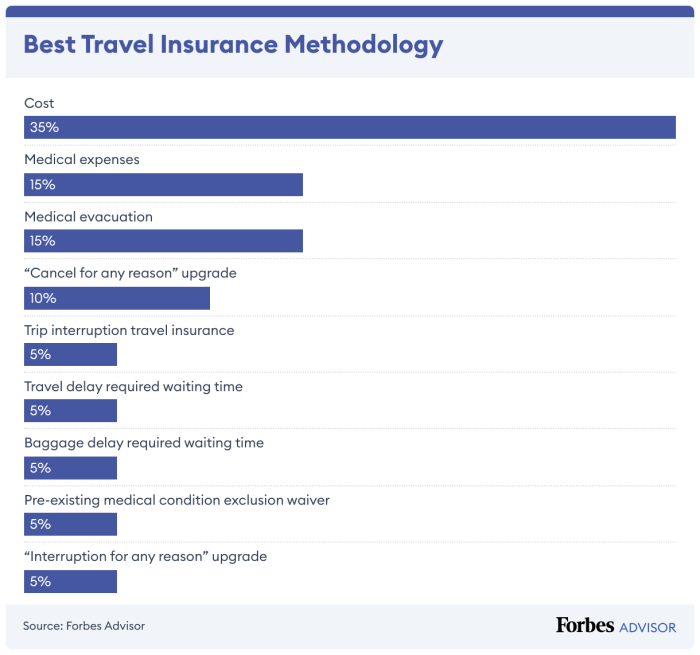

Types of Coverage

When it comes to Nationwide Travel Insurance, there are several types of coverage options available to travelers. Each type offers different levels of protection and benefits, so it's important to understand them in order to choose the best one for your needs.

Medical Coverage

Medical coverage is essential when traveling, as it provides protection in case of unexpected illnesses or injuries. This type of coverage typically includes reimbursement for medical expenses, emergency medical evacuation, and repatriation of remains in case of death.

Trip Cancellation and Interruption

This coverage helps protect your investment in case you have to cancel or interrupt your trip due to unforeseen events such as illness, natural disasters, or other emergencies. It typically reimburses you for non-refundable expenses like flights, accommodations, and tours.

Baggage and Personal Belongings

Baggage coverage provides reimbursement for lost, damaged, or stolen luggage and personal belongings during your trip. This type of coverage can help you replace essential items and continue your journey without major disruptions.

Additional or Optional Coverage

In addition to the standard coverage options, Nationwide Travel Insurance also offers additional or optional coverage that can be added to your policy for extra protection. This may include coverage for adventure activities, rental car damage, or pre-existing medical conditions.Overall, Nationwide Travel Insurance provides a range of coverage options to suit different travel needs and preferences.

It's important to carefully review the details of each type of coverage to ensure you have the protection you need during your travels.

Claim Process

![Nationwide Travel Insurance Review --- Is It Worth It? [2025] Nationwide Travel Insurance Review --- Is It Worth It? [2025]](https://vinyl.eastcanyonhotel.com/wp-content/uploads/2025/12/ceb1c40e863194498082d8a38458ff80.jpg)

When it comes to filing a claim with Nationwide Travel Insurance, it is important to follow the proper steps to ensure a smooth process. Here is a guide on what travelers need to do in case they need to make a claim and some tips on how to expedite the claim process.

Filing a Claim with Nationwide Travel Insurance

- Notify Nationwide Travel Insurance as soon as possible: Contact the claims department of Nationwide Travel Insurance immediately after the incident occurs.

- Submit required documentation: Be prepared to provide all necessary documentation to support your claim, such as police reports, medical records, and receipts for expenses incurred.

- Fill out claim forms accurately: Make sure to fill out all claim forms accurately and completely to avoid any delays in processing.

- Cooperate with the claims adjuster: Be cooperative and provide any additional information or documentation requested by the claims adjuster promptly.

Tips to Expedite the Claim Process

- Keep all documentation organized: Keep all relevant documentation in one place and easily accessible to expedite the claim process.

- Follow up regularly: Stay in touch with the claims department and follow up regularly to check on the status of your claim.

- Be proactive: Provide any additional information or documentation proactively to avoid delays in processing.

- Understand your policy: Familiarize yourself with your policy coverage and exclusions to ensure your claim is within the scope of coverage.

Exclusions and Limitations

When purchasing Nationwide Travel Insurance, it is crucial to understand the exclusions and limitations of the policy to avoid any surprises during your trip. Here are some common exclusions and limitations that travelers should be aware of:

Pre-existing Medical Conditions

- Most travel insurance policies do not cover pre-existing medical conditions unless specified in the policy. This means that any medical treatment related to a pre-existing condition will not be covered.

- Travelers with pre-existing conditions may need to purchase additional coverage or a specific policy that includes coverage for their medical history.

Adventure Sports and Activities

- Many travel insurance policies exclude coverage for injuries or accidents related to extreme sports or activities such as skydiving, bungee jumping, or scuba diving.

- Travelers participating in adventure sports should check if their policy includes coverage for these activities or consider purchasing additional coverage.

Travel to High-Risk Countries

- Some travel insurance policies may have exclusions for travel to countries with high security risks or political instability.

- Travelers planning to visit high-risk countries should review their policy to ensure coverage will apply in these destinations or consider purchasing a separate policy for such trips.

Unapproved Destinations

- Travel insurance may not provide coverage for trips to destinations that are under travel advisories or considered unsafe by government agencies.

- Travelers should check if their destination is approved by their insurance provider to avoid any coverage limitations.

Conclusion

In conclusion, nationwide travel insurance stands as a vital companion for globetrotters, offering protection and security throughout their explorations. By understanding the nuances of coverage and claim processes, travelers can embark on their journeys with confidence, knowing they are well-prepared for any unexpected twists along the way.

Q&A

What does Nationwide Travel Insurance cover?

Nationwide Travel Insurance typically covers medical emergencies, trip cancellations, lost luggage, and other unforeseen incidents during travel.

Are pre-existing medical conditions covered under Nationwide Travel Insurance?

Pre-existing medical conditions are usually not covered unless specified in the policy. It's essential to check the terms and conditions for clarity.

How can travelers expedite the claim process with Nationwide Travel Insurance?

Travelers can expedite the claim process by ensuring they have all necessary documentation, submitting claims promptly, and following up with the insurance provider as needed.