Embark on a journey to discover the best travel insurance options tailored for the current times, focusing on COVID-19 protection. From understanding the types of coverage available to exploring essential factors for decision-making, this guide aims to equip you with the knowledge needed to navigate the complexities of travel insurance in the midst of a global pandemic.

Delve deeper into real-life scenarios where travelers have reaped the benefits of COVID-19 insurance, and gain insights on best practices for securing adequate coverage. Prepare to make informed choices to safeguard your travel plans amidst uncertain times.

Types of travel insurance for COVID-19

Travel insurance for COVID-19 comes in various forms to provide coverage and protection for travelers in these uncertain times. Let's explore the different types of travel insurance available for COVID-19 and their significance.

Basic travel insurance vs. COVID-specific coverage

- Basic travel insurance: Traditional travel insurance typically covers trip cancellations, delays, lost baggage, and medical emergencies. However, it may not include coverage specific to COVID-19-related issues.

- COVID-specific coverage: This type of insurance is designed to address COVID-19-related concerns such as trip cancellations due to the virus, emergency medical treatment for COVID-19 abroad, quarantine expenses, and even coverage for COVID-19 testing.

COVID-specific coverage is crucial for travelers in the current scenario to protect themselves against unforeseen circumstances related to the pandemic.

Importance of COVID-19 coverage in travel insurance policies

- Peace of mind: Having COVID-19 coverage in your travel insurance policy can provide peace of mind knowing that you are protected in case of any pandemic-related issues.

- Financial protection: COVID-specific coverage can help mitigate financial losses due to trip cancellations, medical expenses, or other COVID-19-related incidents during your travels.

- Travel restrictions: With the ever-changing travel restrictions and regulations related to COVID-19, having appropriate coverage can help you navigate unexpected situations and ensure a smoother travel experience.

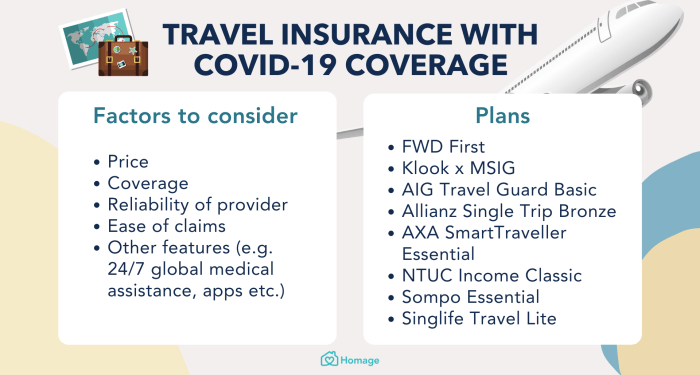

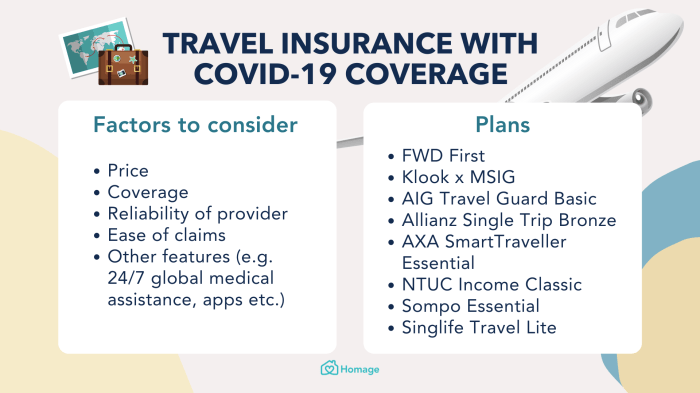

Factors to consider when choosing travel insurance for COVID-19

When selecting a travel insurance plan for COVID-19, there are several key factors that travelers should consider to ensure they have adequate coverage in case of any unforeseen circumstances related to the virus.

Coverage Limits, Exclusions, and Restrictions

- Check the coverage limits for COVID-19-related medical expenses, including hospitalization, testing, and treatment.

- Review the exclusions in the policy to understand what situations related to COVID-19 may not be covered.

- Be aware of any restrictions on coverage, such as travel to high-risk areas or pre-existing conditions related to COVID-19.

Determining Adequate Coverage

- Consider the duration of coverage provided for COVID-19-related expenses during the trip.

- Look for policies that offer coverage for trip cancellations or interruptions due to COVID-19-related reasons.

- Ensure the policy includes coverage for emergency medical evacuation in case of COVID-19 infection while traveling.

Best practices for purchasing travel insurance for COVID-19

When it comes to purchasing travel insurance for COVID-19, there are several best practices to keep in mind to ensure you are adequately protected during your trip.

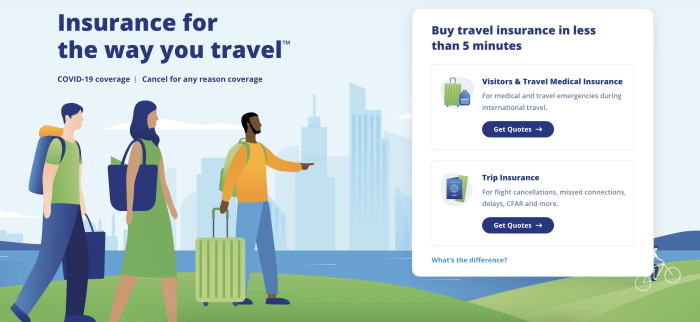

Research reputable insurance providers offering COVID-19 coverage

- Look for insurance providers with a good reputation for handling claims related to COVID-19.

- Check reviews and ratings from other travelers to gauge the reliability of the insurance company.

- Verify that the insurance provider offers specific coverage for COVID-19, including medical expenses and trip cancellations due to the virus.

Compare different travel insurance plans for COVID-19 protection

- Compare the coverage limits, deductibles, and premiums of different insurance plans.

- Consider factors such as medical coverage, trip cancellation coverage, emergency evacuation coverage, and coverage for COVID-19-related cancellations or interruptions.

- Choose a plan that best suits your travel needs and provides comprehensive coverage for potential COVID-19-related issues.

Review the fine print of insurance policies regarding COVID-19

- Pay close attention to the exclusions and limitations related to COVID-19 coverage in the insurance policy.

- Understand the process for filing a claim related to COVID-19 and the documentation required to support your claim.

- Ensure that the insurance policy offers coverage for any COVID-19-related scenarios that are relevant to your travel plans.

Case studies

In this section, we will explore real-life examples of travelers who benefited from having COVID-19 travel insurance coverage. These cases highlight the importance of comprehensive insurance protection during the pandemic.

Traveler A: Medical Emergency Assistance

- Traveler A tested positive for COVID-19 while abroad and required medical assistance.

- Their travel insurance covered the costs of medical treatment, quarantine accommodation, and repatriation.

- Having comprehensive COVID-19 coverage ensured that Traveler A received the necessary care without financial burden.

Traveler B: Trip Cancellation

- Traveler B's flight was canceled due to COVID-19 travel restrictions.

- Their travel insurance reimbursed the non-refundable costs of their trip, including flights, accommodation, and tours.

- By having suitable coverage, Traveler B avoided losing money on their canceled trip and could plan for a future journey.

Traveler C: Quarantine Coverage

- Traveler C was required to quarantine after exposure to someone with COVID-19 during their trip.

- Their travel insurance covered the expenses of extended accommodation, meals, and missed flights due to the quarantine period.

- Thanks to their insurance policy, Traveler C managed the unexpected situation smoothly without incurring additional costs.

Conclusive Thoughts

As we conclude our exploration of the best travel insurance for COVID-19, remember that thorough research and informed decision-making are key. By prioritizing comprehensive coverage and understanding the nuances of policy details, you can embark on your travels with confidence, knowing that you are well-protected.

Safe travels await!

FAQ Compilation

What are the key differences between basic travel insurance and COVID-specific coverage?

Basic travel insurance typically covers common travel risks, while COVID-specific coverage focuses specifically on risks associated with the pandemic, such as trip cancellations due to COVID-related reasons.

How can travelers determine if a travel insurance policy adequately covers COVID-19 risks?

Travelers should carefully review policy details to ensure that COVID-19 risks, such as trip cancellations, medical expenses, and quarantine requirements, are explicitly covered.

Where can travelers find reputable insurance providers offering COVID-19 coverage?

Reputable insurance providers offering COVID-19 coverage can be found through thorough online research, customer reviews, and recommendations from travel professionals.

What factors should travelers consider when comparing different travel insurance plans for COVID-19 protection?

Travelers should consider coverage limits, exclusions, restrictions, emergency assistance services, and the overall reputation of the insurance provider when comparing plans for COVID-19 protection.

Are there specific cases where travelers have benefited from COVID-19 travel insurance? Can you provide examples?

Yes, there have been cases where travelers faced COVID-related issues such as trip cancellations or medical emergencies and were able to receive assistance and coverage through their COVID-19 travel insurance.