As travel insurance comparison becomes increasingly important, this opening passage invites readers into a world of valuable insights and tips, ensuring an enriching reading experience.

Delve into the intricacies of comparing travel insurance plans and unlock the secrets to finding the perfect coverage tailored to your needs.

Importance of Travel Insurance Comparison

When it comes to purchasing travel insurance, comparing different plans is essential to ensure that you get the best coverage that suits your specific needs. Here's why comparing travel insurance is crucial:

Benefits of Comparing Travel Insurance Plans

- Cost-Effectiveness: By comparing different policies, you can find one that offers comprehensive coverage at a competitive price.

- Coverage Options: Each travel insurance plan may offer different coverage options, so comparing them helps you choose the one that includes the benefits you need.

- Policy Exclusions: Understanding what is not covered in each plan is as important as knowing what is covered. Comparing policies helps you identify any exclusions that may affect your decision.

- Claim Process: Different insurance providers may have varying claim processes. By comparing plans, you can choose one with a streamlined and efficient claims process.

Factors to Consider When Comparing Travel Insurance

When comparing travel insurance plans, there are several key factors to consider that can greatly impact the coverage you receive and the overall value of the policy. It's important to carefully assess these factors to ensure you select the best travel insurance plan for your needs.

Coverage Limits, Deductibles, Exclusions, and Pre-existing Conditions

- Coverage Limits: Check the maximum coverage amounts for different benefits such as medical expenses, trip cancellations, and baggage loss to make sure they meet your requirements.

- Deductibles: Understand the deductible amount you would need to pay out of pocket before the insurance coverage kicks in.

- Exclusions: Review the list of exclusions to know what situations or items are not covered by the insurance policy.

- Pre-existing Conditions: Determine if the policy covers pre-existing medical conditions or if there are any restrictions related to them.

Importance of Comparing Benefits

- Trip Cancellation: Evaluate the coverage for trip cancellations due to unforeseen circumstances such as illness, natural disasters, or airline strikes.

- Medical Coverage: Look into the extent of medical coverage provided, including emergency medical expenses, hospitalization, and medical evacuation.

- Baggage Loss: Assess the coverage for lost, stolen, or damaged baggage during your travels.

- Emergency Evacuation: Check if the policy includes provisions for emergency medical evacuation in case of serious injury or illness.

Policy Cost, Customer Reviews, and Claim Processes

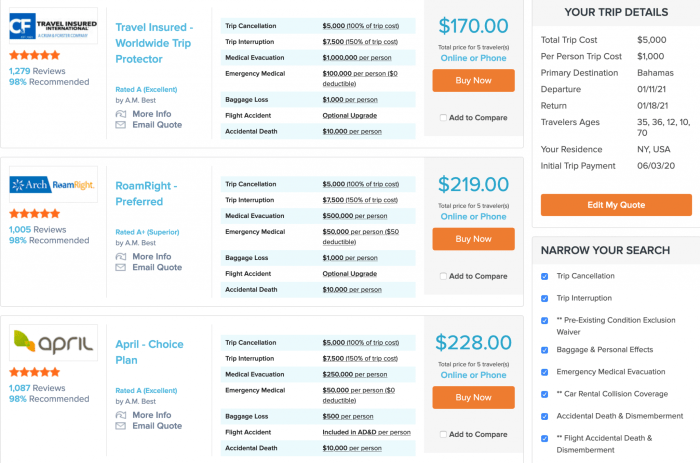

- Policy Cost: Compare the premiums of different travel insurance plans to find a balance between cost and coverage benefits.

- Customer Reviews: Read reviews from other policyholders to gauge the satisfaction levels and the efficiency of the insurance provider in handling claims.

- Claim Processes: Understand the procedures for filing a claim, the documentation required, and the turnaround time for claim settlement.

How to Compare Travel Insurance Plans

When it comes to comparing travel insurance plans, it is essential to carefully assess your needs and find a policy that offers the right coverage at a competitive price. Here is a step-by-step guide on how to effectively compare travel insurance plans:

Utilize Online Comparison Tools

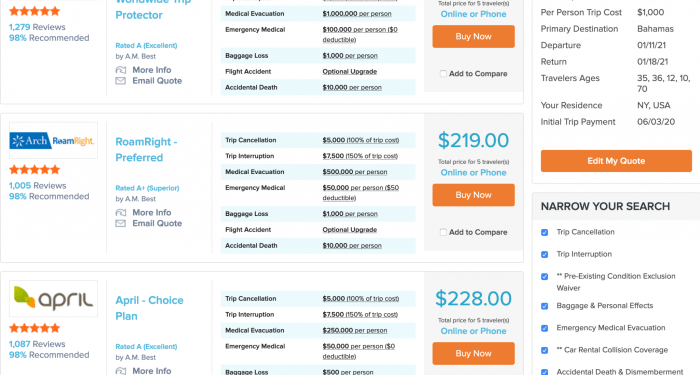

Online comparison tools can be incredibly helpful in streamlining the process of comparing travel insurance plans. These tools allow you to input your travel details and preferences, and then generate a list of policies that meet your requirements. Some reputable websites that offer travel insurance comparisons include:

- InsureMyTrip: InsureMyTrip is a popular platform that allows you to compare a wide range of travel insurance plans from various providers. You can easily filter the results based on coverage limits, price, and other factors.

- Squaremouth: Squaremouth is another trusted website that offers comprehensive travel insurance comparisons. The platform provides detailed information on each policy, making it easier for you to make an informed decision.

- TravelInsurance.com: TravelInsurance.com is a user-friendly website that allows you to compare different travel insurance plans based on your specific needs. You can easily compare prices and coverage options to find the best policy for your trip.

Understanding Travel Insurance Jargon

Travel insurance jargon can often be overwhelming for travelers trying to navigate the world of insurance policies. Understanding common terms like "single trip," "annual multi-trip," "excess," and "repatriation" is crucial for making informed decisions when comparing travel insurance plans.

Single Trip

- Definition:A single trip policy covers you for a specific journey from your home to your destination and back.

- Usage:Ideal for travelers embarking on a one-time vacation or business trip.

Annual Multi-Trip

- Definition:An annual multi-trip policy covers multiple journeys within a year, each with a maximum duration.

- Usage:Suitable for frequent travelers who take multiple trips in a year.

Excess

- Definition:The excess is the amount you agree to pay towards a claim before the insurance company covers the rest.

- Usage:Higher excess can lead to lower premiums, but make sure you can afford the excess if needed.

Repatriation

- Definition:Repatriation covers the cost of returning you to your home country in case of a medical emergency or death.

- Usage:Essential for international travelers to ensure proper arrangements are made in unforeseen circumstances.

By familiarizing yourself with these terms and their implications, you can better understand the coverage provided by different travel insurance plans. This knowledge empowers you to select a policy that aligns with your travel needs and budget.

Closing Summary

In conclusion, navigating the realm of travel insurance comparison can be daunting, but armed with the right knowledge, travelers can make informed decisions and embark on their journeys worry-free.

Essential Questionnaire

What aspects should I consider when comparing travel insurance plans?

When comparing plans, pay attention to coverage limits, deductibles, exclusions, pre-existing conditions, benefits like trip cancellation, medical coverage, baggage loss, emergency evacuation, policy cost, customer reviews, and claim processes.

How can I effectively compare travel insurance plans?

Utilize a step-by-step guide, leverage online comparison tools for efficiency, and explore reputable websites that offer detailed comparisons to make an informed decision.

What are some common travel insurance terms I should know?

Understanding terms like "single trip," "annual multi-trip," "excess," and "repatriation" can help you navigate policies better. Refer to a glossary of essential travel insurance terms for easy reference.